ROSE Chauffeured Transportation has served the Charlotte, North Carolina, area with a dedicated team of drivers, dispatchers, technicians and managers since its 1985 founding by H.A. and Andy Thompson as family-owned limousine business. Now a full-fledged charter company with a fleet of over 35 vehicles (including 21 motorcoaches), the company prides itself on providing a top-to-bottom customer experience which starts with its drivers and extends to each leg of a trip.

“Our drivers are friendly and knowledgeable about the area, but the most important question they ask is, ‘How can I make your trip better?’” said Andy Thompson, president of Rose Chauffeured Transportation. “Our company culture pushes for drivers to be treated fair, and in turn they will treat our customers with fairness and respect.”

The typical bus driver does not like to make changes to their itinerary, Thompson said, but Rose attempts to accommodate every reasonable customer request if it falls within legal driving hours.

A history of evolution

Rose started as Rose Limousine Limited, a company running Rolls-Royce sedans for weddings, anniversaries and other special events. In 1992, the company transitioned away from Rolls-Royce vehicles and into stretch limousines. From there, the company began adding minibuses and changed its name to Rose Chauffeured Transportation in 1995.

In 2008, feeling the recession and needing to expand into new revenue streams, Thompson said the company bought its first full-size motorcoach.

“We started with 14-passenger minibuses, but we were beginning to work more in corporate and convention transportation – which required moving more people than our minibuses would allow,” Thompson said. “For a while, we were ‘farming out’ our motorcoach business to a local provider which wasn’t giving our customers the best service. As a result of all of those factors, we entered the motorcoach business.”

Over the next decade, the fleet of full-size motorcoaches grew to 21 vehicles. Whenever the company found it did not have enough buses to fulfill a certain order, it added another.

The company now has two reservation departments — one for motorcoaches and minibuses, and the other for sedans, SUVs and vans. The accounting department has grown to three employees, while six people work on dispatch.

“We saw that the motorcoach business had a higher profit margin,” Thompson said. “Obviously, the per-ride ticket is higher, and we saw that as a growth opportunity.”

The per diem problem

To run such a driver- and customer-oriented company, Rose relies heavily on its drivers’ ability to make quick decisions and have some level of financial responsibility – and sovereignty – on trips. In the not-too-distant past, Thompson said, Rose would make frequent bank trips for petty cash. The company allotted $25 per day for each driver.

“If we didn’t have cash on-hand for a trip, we’d write and then cash a petty-cash check,” Thompson said. “It was becoming a very cumbersome administrative chore.”

After researching several potential solutions to the “per diem problem,” the Rose team found information on the CommercePayments™ Prepaid Expense Cards from Commerce Bank at the United Motorcoach Association’s 2017 Motorcoach EXPO. After a year of further research and consideration, Rose connected with Commerce at the following year’s EXPO. Within a week, the company was ready to move forward with the Commerce Bank Prepaid Expense Card program.

After researching several potential solutions to the “per diem problem,” the Rose team found information on the CommercePayments™ Prepaid Expense Cards from Commerce Bank at the United Motorcoach Association’s 2017 Motorcoach EXPO. After a year of further research and consideration, Rose connected with Commerce at the following year’s EXPO. Within a week, the company was ready to move forward with the Commerce Bank Prepaid Expense Card program.

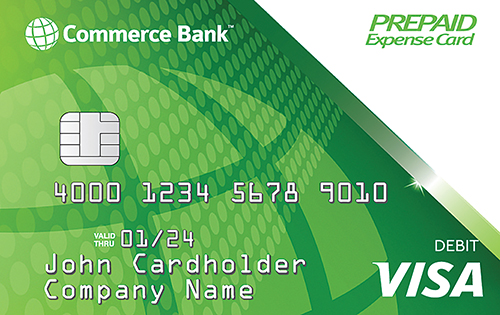

The Prepaid Expense Card is a reloadable, prepaid Visa® card. It can be used to purchase goods and services and is compatible with cash withdrawal from a large nationwide network of ATMs.

The program, which gives employers complete spending control, costs a monthly fee (per card) with no extra charges associated with loading or unloading funds – making it unique among competing solutions. With the card, Rose can set spending limits, monitor spending from a web portal, and restrict cash access. Commerce makes funds available through automated clearing house (ACH) from any bank; unloading is available through an online portal; and real-time funding is available with a Commerce Bank line of credit or a Commerce Bank Visa debit card.

The program’s latest feature allows Rose to list a reason for each card load. By allowing clients to enter alphabetical and numerical values for each loading, Commerce Bank hopes that operators can better streamline finances and accounting.

The program’s latest feature allows Rose to list a reason for each card load. By allowing clients to enter alphabetical and numerical values for each loading, Commerce Bank hopes that operators can better streamline finances and accounting.

“Employees at Rose Chauffeured Transportation like the ease of use that the cards allow,” said Darin Paoli, an account executive with Commerce Bank. “For them, it means a reduction of busywork spent managing per diem pay. It provides Rose with a lot of freedom in terms of driver expenses.”

Mel Marcelo, accounting associate for Rose, said the cards allow the company to easily distribute meal allowances. Previously, the company had to add money on to driver paychecks after a trip to account for meals.

‘Drivers had to wait for their pay, but now they’re paid for meals in advance of a ride,” Marcelo said. “Furthermore, we no longer have to sign checks for reimbursable driver expenses. We simply add that money to the card, and the driver uses it.”

“The card has worked very well for us,” Thompson added, “and the drivers seem to really like it. We’re very happy with this as a creative solution to an old problem.”

Future growth

Paoli said that Commerce Bank will continue improving upon its Prepaid Expense Card solution, aiming to exceed expectations for ease-of-use and streamlined spending.

“We feel that this is such a customizable and strong product,” Paoli said. “That is why so many operators are taking advantage of this solution, and why Rose is poised to continue making its operations more efficient.”

For Rose Chauffeured Transportation, the immediate future includes building on an already-stellar company culture, and attracting new, hard-working drivers.

“We’re lucky to be in a town that’s in a growth mode, because it helps our business,” he said. “The longer we’re in business, it seems our region of coverage continues to grow. We look forward to continuing our growth along with the rest of the transportation industry.”

For information about the Prepaid Expense Card program, call

866-946-3017, email prepaidexpense@commercebank.com or visit commercebank.com/expensecard.