By Steve D. Johnson

Why are offshore original equipment manufacturers (OEMs) targeting North American transit? Everything considered, that is a very fair question. For starters, it is one of the smallest — if not the smallest — public transportation market in the world. Follow that with the rules of engagement as set forth by the Federal Transit Administration (FTA). We will explore both subjects in more detail later, but for now I could name at least seven offshore OEMS that currently do some level of business in North America transit. Some sell into non-transit segments primarily but all aspire to more active in transit. A top executive at Marco Polo, a large Brazilian bus manufacturer, when asked why the U.S. transit market was off limits once said, “Anybody who seriously considers entering the U.S. transit market must be out of their head.” He realized the obstacles to success and also knew that many had tried and failed.

That was 20 years ago and most OEMs entered through joint ventures (JV). Times and thinking have changed. I can mention one of the seven OEMS referenced earlier by name. They are Alexander Dennis Limited (ADL) out of the United Kingdom. ADL is not the first U.K.-based OEM to enter the U.S. market but have had the most success in transit. ADL makes double decker buses which says that if you have a niche, you’re in. What did ADL and the others find out when they did their market research?

Does size matter?

Does size matter?

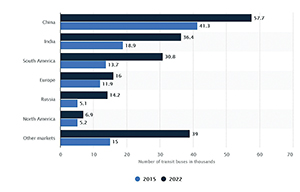

When you compare the size of the U.S. transportation market to other world markets, one would have to conclude that you would need a very compelling reason to play here. Statista, one of many research firms that track bus production globally, shows the U.S. is clearly the smallest market among developed countries when looking at heavy-duty (HD) transit buses, 40 foot (12M) and 60 foot (18M). These are the most expensive and the segment most targeted. With the recent adoption of HVAC in Eastern Canada, our number for the North American served market is approximately 7,000 HD buses annually. If medium- and light-duty buses were included, the number would be much bigger for all countries. However, the U.S. would still be the smallest. So, based on today’s landscape and the fact that global OEM activity continues, I can safely conclude that size does not seem to matter. There must be something else driving these initiatives. What else did these OEMS discover during their market research?

The rules of engagement

There are rules around the allocation and use of the $12 billion the FTA provides annually to subsidize transit. Any supplier wishing to enter the transit market will quickly encounter these during the market research period. The hard requirements include these:

- The bus must be Department of Transportation (DOT) compliant. Different countries have slightly different rules of the road, some less stringent, some more.

- The bus must survive Altoona testing. This to ensure that the bus is structurally sound.

- The bus must comply with Buy America. This is a tough one as it fairly dictates that you will need to build the bus in the U.S. with U.S. labor and materials. The current threshold mandates 65 percent and that will rise to 70 percent in 2019.

- For the transit agency to receive the 80 percent subsidy, the bus must be used for a minimum of 12 years or 500,000 miles. In some countries seven years is the expected first life.

- The rules of fleet defect say that if you have a failure affecting 20 percent of the fleet, the entire fleet must be upgraded, and the warranty is suspended until the fix is implemented.

The soft requirements which in reality may be the most difficult to achieve are driven by the expectations of the transit. You must be competitive in total life cycle and operating cost, have a good service network that is responsive, a good parts distribution system with sufficient stocking levels and dedicated corporate support after you make the sale. Failure to meet these expectations could mean a short lived experience in the market. It’s a small market and word gets around quickly.

That brings us back to the original question, why? An OEM from Eastern Europe finally gave me the answer. It’s about the opportunity for revenue and profit if you consider that buses sell for about twice the price here. If you can meet all of the requirements and offer a lower priced bus, you will attract some buyers. That theory does work to some extent but the domestic OEMS still have the edge. They know transit and the associated nuances that the new entrants must learn.

As a HVAC supplier, I can tell you that new entrants does not just apply to buses. Several new suppliers have entered with HVAC as well. It has been said that a little competition is healthy. It makes the incumbents work harder. At the end of the day we are all stronger and so is the market.

Steve D. Johnson, Sr. serves as product marketing manager, Bus HVAC, at Thermo King, Minneapolis, MN. Thermo King is a world leader in transport temperature control systems for buses. Thermo King also manufactures auxiliary power units, which dramatically reduce engine idling. All Thermo King products are backed by a nationwide dealer network.